Financing Bad Credit Can Be Fun For Everyone

Debtors with poor credit report might receive reduced interest rates since they're installing security. If you fail on a secured finance, your lender might legally confiscate your collateral to recover the cash - financing bad credit. As well as if your lending institution doesn't recover the expense of the loan by retrieving your assets, you may be accountable for the distinction.

All about Financing Bad Credit

Consumers who have excellent histories with their financial institution. If you're in need of a temporary fix, you can make use of an already beneficial partnership for monetary assistance.

Like personal loans, with a house equity car loan, you'll be given the cash in a round figure. Those who require large amounts of cash and have equity in their house Allows debtors to take out as much as 80% of their residence's worth. Because you're using your house as security, back-pedaling your residence equity funding might lead to shedding your home.

Unlike house equity financings, HELOCs normally have variable rate of interest (financing bad credit). Debtors who aren't sure just how much cash they want and needs to be able to obtain from their home's equity over an amount of time Customers can obtain and pay back as needed, and recycle the line of credit scores. Considering that rate of interest vary, borrowers may experience extremely month-to-month settlements.

Some Known Questions About Financing Bad Credit.

While many lenders do not permit borrowers to make use of an individual finance toward education and learning financing, lenders like Startup do permit for it. Those who are going after financing for educational objectives Some pupil lending lending institutions will certainly hide to the whole cost of your tuition. Some lenders have rigorous or obscure forbearance as well as deferment programs or none at all in case you're incapable to pay off the funding later on.

Account for all individual earnings, including wage, part-time pay, retirement, financial investments and also rental properties. You do not need to consist of spousal support, kid assistance, or separate maintenance revenue unless you want it to have it considered as a basis for settling a finance. Increase non-taxable earnings or benefits consisted of by 25%.

The offers for economic items you see on our platform come from business that pay us. The money we make helps us provide you accessibility to free credit history and reports and aids us develop our various other terrific tools and academic products. Payment might factor right into how as well as where products appear on our platform (and in what order).

How Financing Bad Credit can Save You Time, Stress, and Money.

That's why we offer functions like your Approval Probabilities as well as financial savings quotes. Certainly, the deals on our system don't represent all financial products out there, yet our objective is to reveal you as numerous excellent options as we can. That doesn't suggest you need to surrender. If you require the cash for a real emergency situation expenditure or various other usage, you can find lenders that supply personal car loans for bad credit rating.

They come with expenses, consisting of origination, late and also insufficient funds fees that might enhance the quantity you have to repay.

99 to get a credit-builder finance, but you can earn benefits to counter the fee. With a lot of credit-builder financings, you need to wait till you make all your settlements to get your money. With Cash, Lion, you obtain a part of your car loan continues in advance, and also the firm puts the rest in a credit report reserve account that you can access at the end of your car loan term.

How Financing Bad Credit can Save You Time, Stress, and Money.

Earnin is an application that provides rate of interest- as well as fee-free money breakthroughs of up to $750, using your next income as collateral. Making use of Earnin does not impact your credit scores, however to utilize the app you require a constant income, straight down payment into a checking account and also a dealt with work area. If accepted, you might have the ability to obtain your money on the exact same day.

What Does Financing Bad Credit Do?

Whether you desire to combine high-interest financial obligation, finance a house enhancement or take treatment of an emergency expense, an individual finance might assist. Right here are some points to understand if you're thinking about requesting an individual finance with bad credit rating. If you have negative credit score, an individual finance see this here might cost you extra because lenders might see you as a higher credit history threat.

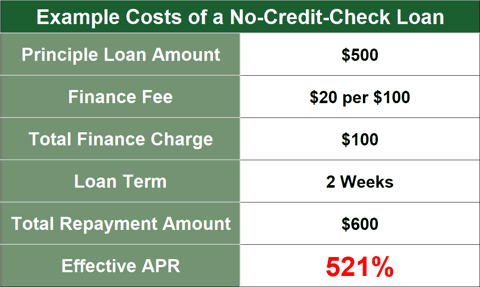

Here are a few standard terms to pay interest to. APR is the overall price you pay yearly to borrow the cash, including passion as well as certain fees. A reduced APR suggests the loan will commonly cost you much less. A personal loan for someone with poor credit will likely have a greater APR.

A lot of personal loans require you to make set month-to-month payments for a set amount of time. The longer the settlement period, the even more rate of interest you'll likely pay, and also the more the finance is likely to cost you. Month-to-month payments are greatly established by the linked here amount you borrow, your rates of interest and your lending term.

While certifying for an individual car loan can be difficult as well as costly for someone with bad credit history, loaning might make sense in certain scenarios.

Comments on “Things about Financing Bad Credit”